In today’s fast-paced digital economy, financial transactions happen in seconds — but that speed also introduces risks. Incorrect bank details, fraudulent accounts, and delayed payments can cost businesses both time and money. That’s where automatic bank account validation steps in, providing a seamless and secure way to confirm account details in real time.

Whether you’re an eCommerce company, fintech startup, or large enterprise, implementing automatic validation ensures your transactions are accurate, compliant, and fraud-free.

What Is Automatic Bank Account Validation?

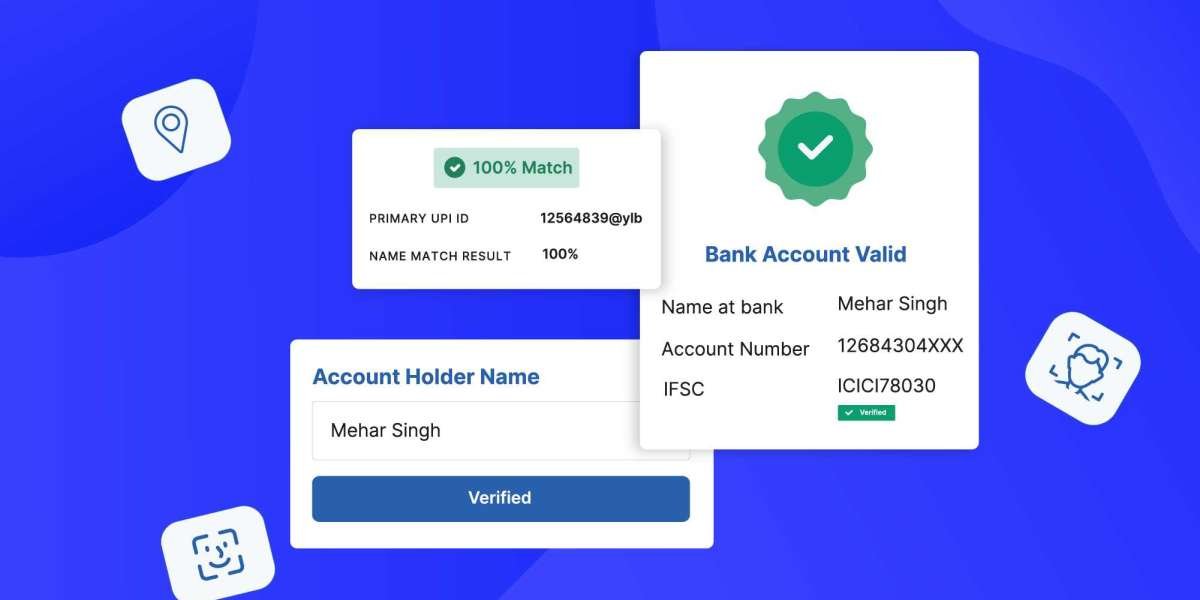

Automatic bank account validation is a digital process that verifies whether a customer’s or vendor’s bank account information is correct and active — instantly. It ensures that the account number, IFSC, IBAN, or routing details match the registered bank records before processing a payment.

This verification happens through secure APIs that connect with banks or trusted data networks. By automating the process, businesses eliminate the need for manual checks and reduce the risk of errors and fraud.

How It Works

Data Entry: A user or business inputs bank account details during payment setup or onboarding.

API Verification: The system connects to authorized databases or banking networks to verify the details.

Validation Results: Within seconds, it confirms whether the account is valid, active, and matches the provided name.

Transaction Approval: Once verified, the payment or transaction proceeds smoothly and securely.

This automation not only accelerates the payment process but also ensures accuracy at every step.

Key Benefits of Automatic Bank Account Validation

1. Fraud Prevention

One of the biggest advantages of automatic bank account validation is fraud detection. By confirming account authenticity before processing payments, businesses can block fraudulent transactions and protect themselves from scams or identity theft.

2. Enhanced Payment Accuracy

Manual entry errors like incorrect account numbers or misspelled names can lead to failed transactions and refund hassles. Automatic validation ensures error-free payments by instantly verifying every detail.

3. Faster Onboarding

For businesses dealing with vendors, freelancers, or customers, automatic validation speeds up onboarding. There’s no need for manual documentation or physical verification — everything happens digitally and in seconds.

4. Improved Customer Trust

Customers appreciate secure and seamless experiences. By integrating real-time validation into your payment process, you show commitment to safety and reliability — which helps build long-term trust.

5. Regulatory Compliance

Many regions now require businesses to follow Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Automatic validation supports compliance by verifying that the provided account belongs to a legitimate individual or organization.

Industries That Benefit from Automatic Bank Account Validation

Fintech Platforms: For secure account linking and instant fund transfers.

eCommerce Businesses: To ensure refunds and payouts reach verified customers.

Payroll Systems: To verify employee bank details before salary processing.

Lending Institutions: To validate borrower accounts and prevent fraud.

Insurance Companies: For secure premium collections and claim disbursements.

Essentially, any business handling large volumes of digital payments can benefit from this technology.

Choosing the Right Automatic Bank Account Validation Solution

When selecting a validation provider or API, consider:

Integration Capabilities: Look for APIs compatible with your existing systems.

Data Security: Ensure encryption and compliance with banking regulations.

Coverage: Choose a provider that supports multiple banks and regions.

Response Time: Instant verification should occur within seconds.

Scalability: The system should handle high transaction volumes efficiently.

Leading financial technology providers offer AI-powered validation that uses machine learning to detect unusual patterns, further reducing risk.

Conclusion

In an era where digital transactions dominate, automatic bank account validation is no longer optional — it’s essential. It not only safeguards businesses from financial fraud but also improves payment speed, compliance, and customer experience.

By adopting this technology, companies can ensure every transaction is accurate, verified, and secure — paving the way for a smarter, safer financial ecosystem.